What Is A Credit Score And How Do You Build A Good One?

A credit report is a document specific to you that records all credit applications for finance applications (Credit Cards, ZipMoney, Latitude, or pay-day lenders) or service applications (such as utilities or your phone contract) for services that have been applied for, whether these loans or services have been approved or not. A credit score is an algorithmic number which is calculated based on the behaviour of yourself as a consumer, from the information contained within your credit report. If you have a bad credit report, your score is lower, if you have a good credit report your score is higher.

It is absolutely imperative to have a high credit score if you want to be approved for finance or gain access to premium products with better interest rates. Having a low score may see your request for home finance denied, and your dreams of home ownership on the back-burner.

YOU DO NOT NEED TO TAKE OUT CREDIT TO “BUILD YOUR CREDIT FILE,” AS APPLICATIONS OF CREDIT WILL LOWER YOUR CREDIT SCORE, NOT IMPROVE IT!!

In the past, credit reporting had only been on “negative” reporting, meaning that only when you did something bad was it recorded against you. With the introduction of positive credit reporting, consumers now have both positive and negative credit habits recorded on their credit report.

This allows lenders to have a better understanding of their potential clients credit history, positive and negative, and could be beneficial for people who have the means to take on a loan but may have had a few marks on their report in the past, such as one or two missed payments. When a lender can see positive behaviour it opens up your options for credit services.

Previously, using a phone bill as an example, if you missed one monthly payment you would have 1 x negative mark on your credit report and nothing else. With the introduction of positive credit reporting you, and missing one payment your report would show 1 x missed payments, and 11 payments made on time. Now lenders can better understand your credit risk and are looking at both sides of the coin (not just the negative) to decide whether you are a good fit to lend to.

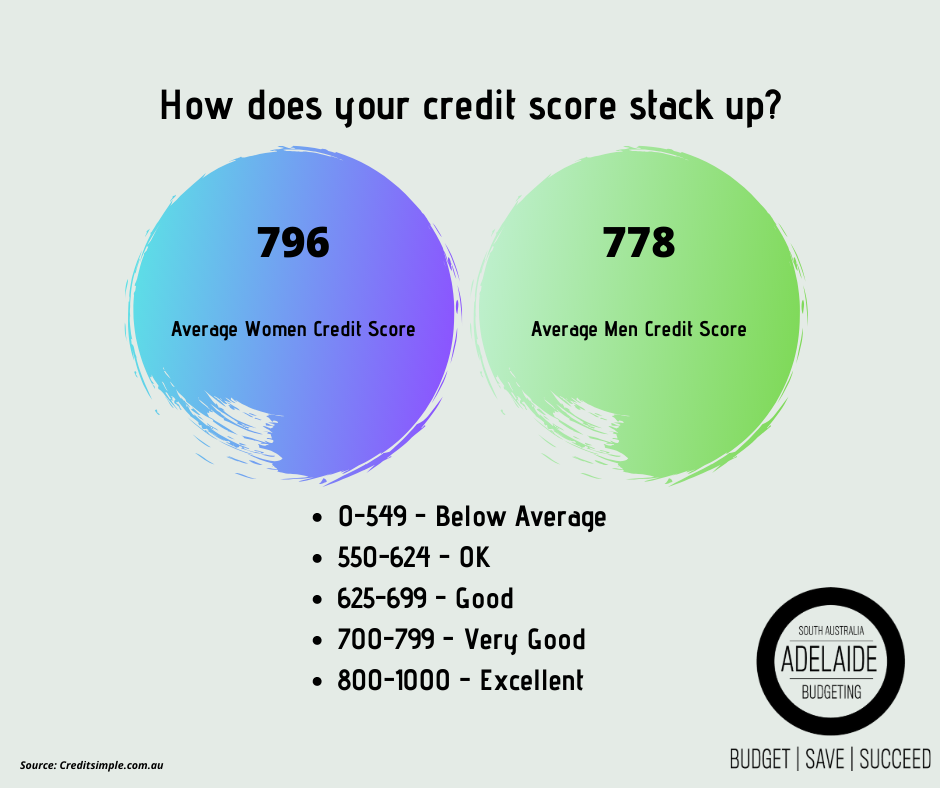

As mentioned prior, a credit score is a number, connected to a complex algorithm that rises and falls based on your behaviour, attitude and conduct of credit-based services, and based on what is recorded in your credit report. What does this mean? Well… do you make sure you pay your utility bills on time, everytime? Are you always applying for credit services? Refinancing? Requesting new credit cards? These all have an effect, positive and negative on your credit score. The higher score you have, the better conduct and attitude towards these services are. The more you abuse the system, the lower your score will be.

It is so important to make sure that your behaviour is positive and consistent because if your number falls below a certain point you could be denied finance. If you are approved for finance, you may receive a higher interest rate (especially for home loans) and may not get the best deal on the market. If you want the best deal, the least possible interest rate, then your attitude and repayments to these services must be positive in conduct.

What can have a negative effect on your credit score?

- Applying for a new loan or credit card.

- Multiple requests for credit in very short periods of time (such as enquiring with multiple lenders at one time).

- Late repayments to your providers.

- A change to your credit limit on an existing loan or credit account.

- New information from a creditor.

- Closing a loan or credit card account.

- Applying for services such as ZipPay, Latitude Humm, and other credit related services.

You can improve your credit score by:

- Not applying for credit related services.

- Lowering your credit card limits (or closing credit cards altogether).

- Limiting your applications for credit.

- Making your repayments on time, every single time!

- Paying your services and loans on time, every single time!

- Paying your mortgage and other loans on time – always.

- Paying your credit card off in full each month, every single time!

If you are always relying on using credit cards and/or credit services, then why? Is it because you spend more than you earn, or you don’t budget effectively? Why not consider using a debit card and closing your credit card…?

Consider this, if you save $1000 and put it on a debit card that essentially acts as a “credit card” with a $1000 limit. The difference? You are spending YOUR money, not the lenders. Depending on what you use it for may have a negative impact on your digital footprint, but when you use it to spend you could “repay” the debit card back up to its $1000 “limit,” and it’s all controlled by YOU.

If you want to stop relying on credit services and make sure you can pay your bills on time, speak to us today so we can help you.

Get your credit score here: https://www.getcreditscore.com.au/

Get a copy of your credit report here: https://www.equifax.com.au/personal/