The “Simplicity” of Knowing your numbers & The Benefits of having & using an Effective Budget

Many of our clients say they know how to budget, yet when we ask them if they are saving money they say no. Why not we ask? “Well… we put money away during the month only to have to take it out again to pay bills. Bills are always taking our money from savings.” Well… that’s because you have forgotten the key fundamental of budgeting… paying yourself first!

When you pay yourself first you take 10% of your entire household net income and put it into an online e-saver, savings account anywhere you cannot touch it. This means that you are forever and always working with 90% of your net income for budgeting and have money saved away for your longer-term goals. Say you earn $400 per week, well that means $40 gets deposited into your online e-saver and you must survive and thrive on $360.00 per pay cycle. As a couple, earning $1500.00 net each week, that means $150 is deposited and you must live off $1350. Sound like a challenge? It’s achievable and easy once you know how!

The key is sticking to a budget is designing a budget that works for you and your lifestyle. One that sorts out your finances and gives structure to the flow of all that you do. Allocating enough funds to cover your expenses, debts and bills means that when your bills arrive that you can pay them immediately! Living life this way may not be the sacrifice you think it is, but in-fact the key to your financial freedom!

It can feel so empowering knowing that your savings are in an e-saver unable to be touched helping you achieve your longer-term goals leaving you with plenty of money each pay cycle to live your life with ease. Yet, still so many people say they cannot afford to pay their bills when they arrive… but could you put away $50 per week and put this money away for bills ahead of time? What about $100 per week? Of course you can… but what are your magic numbers to make it all flow? When you look at a budget everything must flow; and work for you! It’s not the big-bad sacrifice we make it all to be in our minds…

The purpose of your household budget is to move money from one spending category to another…

Simple right? Well it is when you know your numbers…

Instead of shelling out $50 for lunch at work every week, why not put the money towards a weekly date night with your partner? Consider what you are spending on a weekly basis and what you can cut back on to help you achieve your longer-term goals such as saving towards a deposit for your first home.

When people start on a program with us they expect instant gratification (but we arent AfterPay! never ever ever use Afterpay). A budget is NOT instant gratification, nor is it sexy… but what it can do for you; over time; can change the entirety of your life and is well worth investing in. Think about this… do you know how much money you spend each week? What your actual spend is? Most people don’t and at a recent presentation conducted by Adelaide Budgeting (collaborating with IMPACT Adelaide West) in July this year, most people attending the presentation simply did not know the numbers for their weekly spending and due to this could not fill out a basic budgeting template – including their income. That’s astonishing!

How do you know where you are going if you don’t know where you are?

A budget can guide you with spending goals and help you to cap your spending in most instances. It can help you eat healthier by avoiding junk food and planning each of your meals in advance. It can help you lose weight and improve your confidence knowing that every minute of every single day that you are getting closer to achieving your longer-term goals. At Adelaide Budgeting we truly believe that a budget that works for you and helps you gain everything you want out of life is the sexiest tool there is!

Do you want to watch your debts disappear and your savings grow?

When you have a budget to follow you can easily track your spending and savings goals. You will know if you are spending more than you planned and that can help to trigger thoughts and conversations with your partner about the positive priorities in your life. What are you both working towards? Why is this important to you both? And… what can you both do to ensure you keep moving forward together?

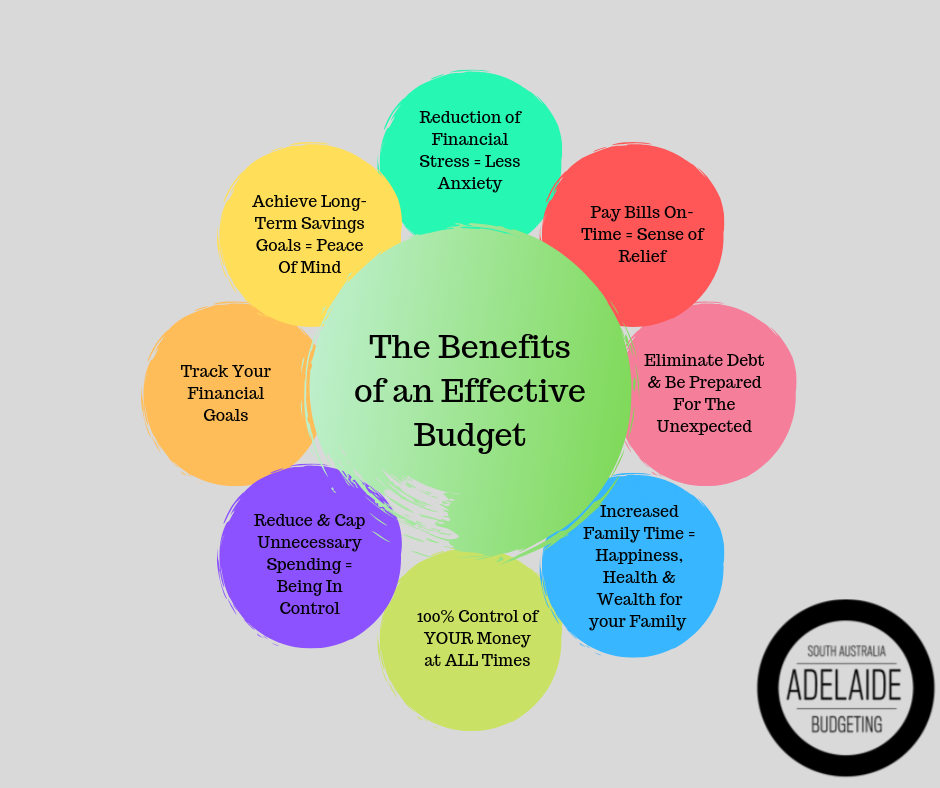

A good budget becomes routine, and in time you don’t even realise you have a budget. Life just becomes “normal living.” A budget will help you save more of your money; pay down your debts; achieve your long-term goals; pay your bills on-time; and be accountable for any excess spending.

If you are ready for real results in your life we encourage you to get in touch today!