Establishing Your Financial Foundation

Knowing that you need help with your finances can be scary. There are a myriad of providers out there, all who want to help you succeed with your financial goals. But who do you go to first?

For home buyers the normal first step is to go to a mortgage broker or a bank, right? Well, if you don’t have a budget in place, or true genuine savings established, then a bank or broker will not be able to help you.

For people wanting to grow their wealth the first step would be to speak with a financial planner right? Well, if you don’t have a budget which outlines your core goals, and how you want to invest, what amount and on what frequency then a financial planner may be able to help you, but potentially not as effectively as they could if you had a budget in place…

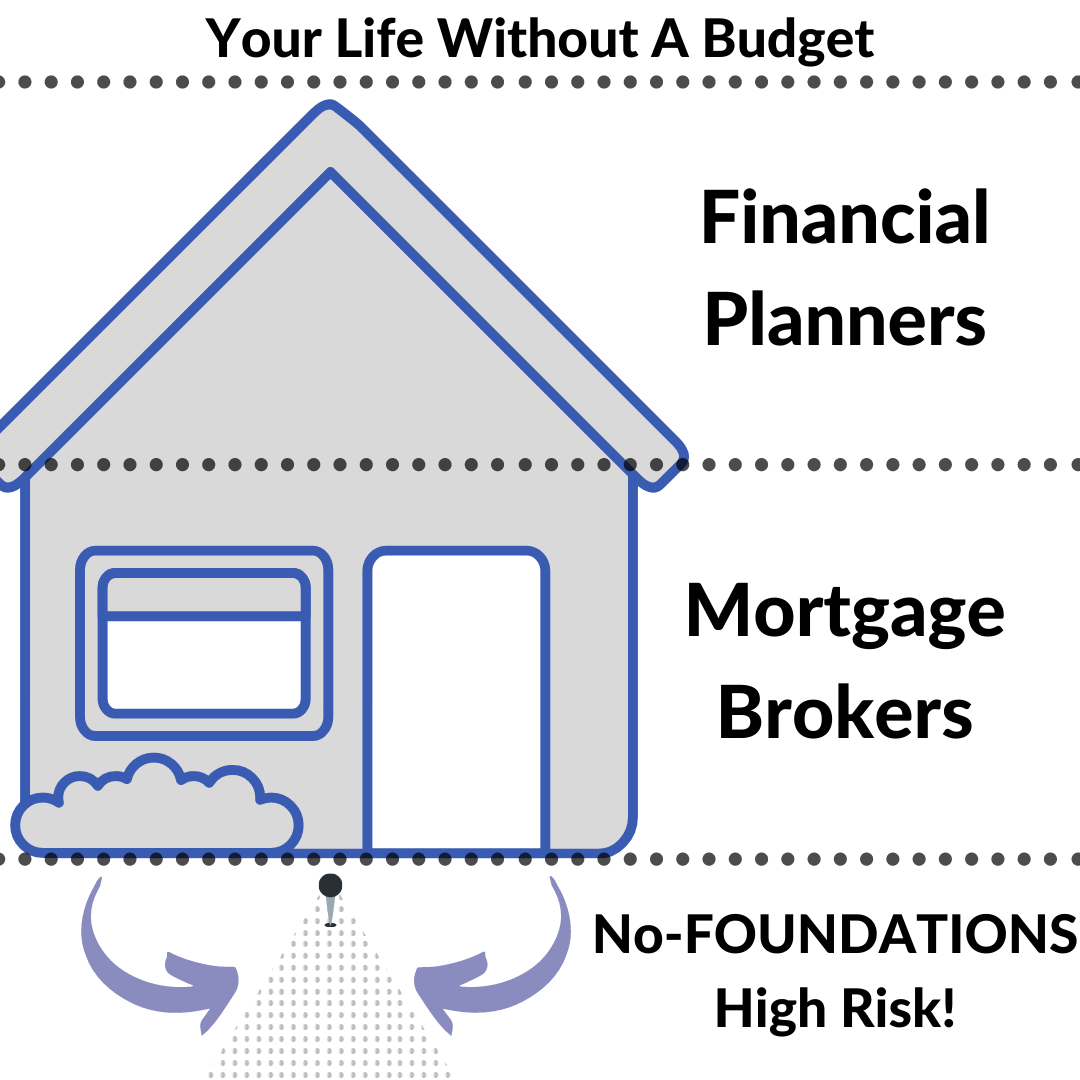

So, what is the best way forward before you speak with a mortgage broker, your bank, or a financial planner? Your first step is your foundation, and developing a foundation that matters is as simple as building a house. Think about it this way… you wouldn’t build a house on a pin head… would you? Surely not, it would fall over! What you need to do to build a house is develop solid footings and these can vary based on what you are “building.” Strip footing for timber floors, solid concrete slabs for a more modern build. Regardless which way you go – before you build the walls, and put on the roof of your financial foundation, you need to do your ground work.

Rather than building on a pinhead as illustrated above – or shooting blind, hoping to secure finance for your first home, you need to develop a plan to establish a solid foundation. A plan that is in synergy and congruent with your short and long-term goals. A plan that supports reduction of debt, consistent living expenses, and true genuine savings over an extended period of time. The plan, that supports your goals, needs to become habit. Repetition of positive financial habits will give you a rock-solid foundation on which to establish, build, grow and nurture your financial future.

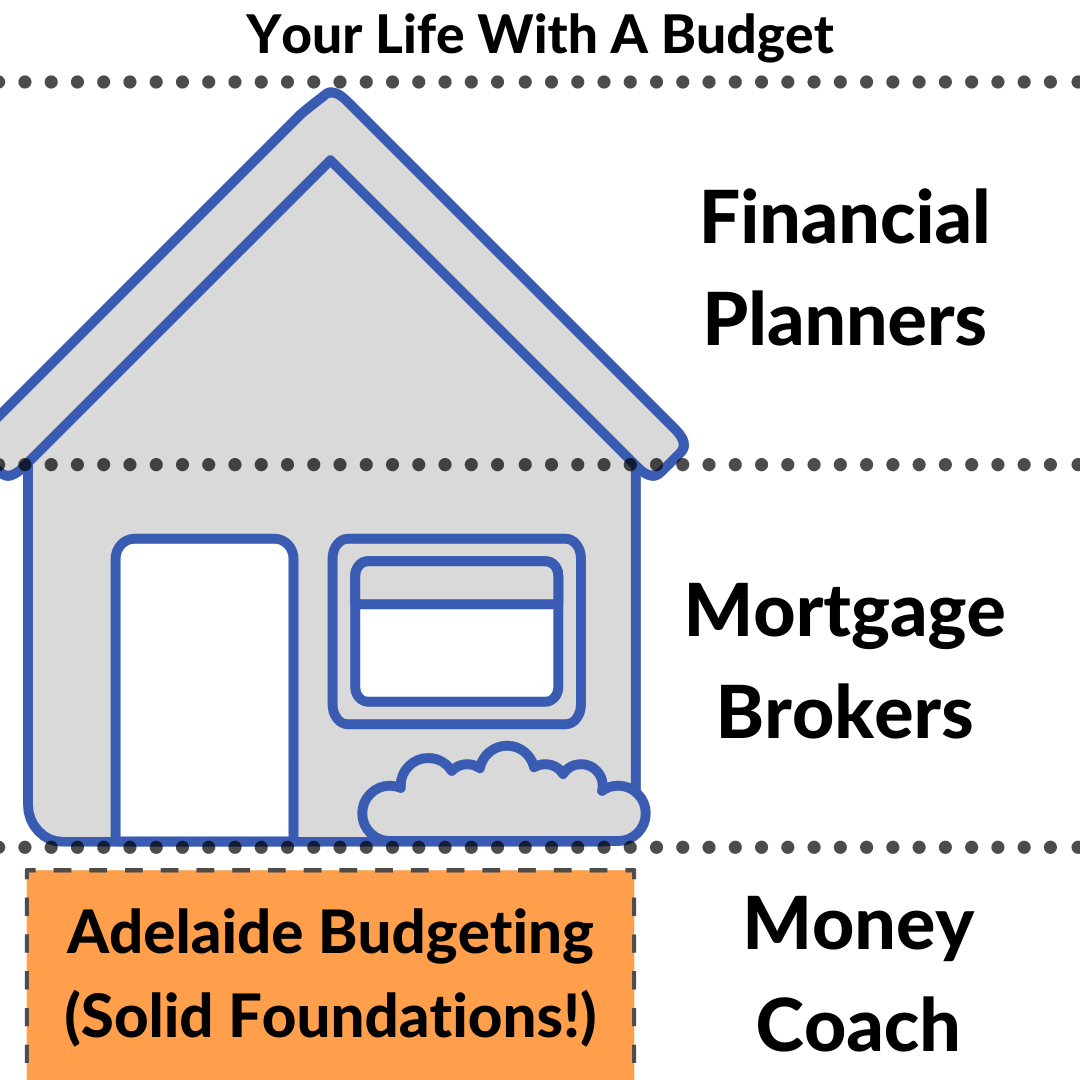

Per illustration above, a BUDGET is the glue, the nucleus of what holds everything together in your own financial world. Your budget is essential to developing your life-long financial goals and freedom.

Your first step in establishing your financial foundation is to develop a budget that makes sense to your life and encapsulates all your goals, dreams and ambitions. The next step is to work it, and develop good positive long-term financial habits. An Adelaide Budgeting Money Coach can help you establish a budget that works for you – AND – introduce you to a mortgage broker for your property goals – AND – introduce you to a financial planner for your investment goals and insurance needs.

Working with a team of professionals is key to helping you develop your own personal financial future. A mortgage broker will only look at your ability to service (pay) your mortgage and does not provide a budget for you. Financial planners will look at your insurances and how your investments are performing, they also, will not do a budget for you. Budgeting for us is a holistic approach where we need to look at all angles to help you get to where you want to be. We do not provide you with “just a budget” and send you on your way.

We welcome you to experience the Adelaide Budgeting difference today.