With so much fear and confusion pushed out by the mainstream media of consistent rate rises over the last few years, it may seem that buying a home in todays market is near impossible, and it just might be which begs the question… Are you truly ready for home ownership?

For many renters that are considering the jump to home ownership there is an assumption that the costs of being a renter vs a home owner are ‘about the same’ just instead of paying the landlord each week you pay a mortgage each month – but this simply isn’t the case.

For example, when you consider the average mortgage loan amount as of today, Friday the 1st of March 2024 you have national average loan balance of $624,000 as of December 2023 (the last reported average).

On a loan of $624,000 at 6.5% interest rate you would have a monthly commitment of $3,944.10 or $910.18 per week.

When you compare your mortgage payments to the average rent in Australia 2024 of $580 per week you quickly realise that the cost of being a home owner purely from cost of rent vs cost of mortgage, equates to an additional $330 per week out of your pocket where interest rates reside at 6.5%.

Couple this with the additional costs of being a home owner you could easily add another $6,000 – $9,000 of costs relating to council rates, building insurances and other associated home ownership costs.

In the above scenario, tenants paying the average $580 per week, seeking an ‘average mortgage loan balance’ of $624,000 would be in a significant worse-off position of $26,169.25 annually, over $500 per week.

Home ownership a few years ago made more sense when rates were lower, for example the average loan of $624,000 at 2.5% had a monthly repayment of $2465.55 per month, or $568.97 per week – on par with today’s average rent costs + home ownership costs.

So, what can you do in today’s market?

Well, you can’t dictate rates… But you can borrow less, and manage your outgoing expenses. And remember: Just because your lender or broker says that you can afford to borrow up to X amount, does not mean that you need to! Always seek to borrow less where possible.

Consider the above example of a tenant paying $580 per week in rent seeking a mortgage with a loan amount of $350,000 at 6.5% interest. Repayments would be approximately $2,212.24 per month, or $510.52 per week. In this scenario you would be in a financially better-off position by reducing the debt level you seek to secure your property by $70 per week simply by reducing your loan amount!

You would still have home ownership costs of let’s say $9,000 on top of this which would bring your repayments + home costs up to an average of $683.59 per week. Just $100 more per week than what you were paying in rent.

Another key metric to consider is your average nett household income vs your annual mortgage cost for example:

Scenario A: Let’s say nett household income of = $130,000, vs loan amount $624,000 (national average), annual payments of $47,329.25. When you divide $47,329.25 by your nett household income you come up with a percentage of 43% for your mortgage.

VS

Scenario B: Let’s say nett household income of = $130,000, vs loan amount $350,000 (your reduced loan value), annual payments of $26,546.86. When you divide $26,546.86 by your nett household income you come up with a percentage of 27% for your mortgage.

Scenario A is not sustainable long-term as 43% of your nett income goes out the door each pay cycle leaving you little to any money for fun or other lifestyle costs (groceries, bills, schooling, fun etc). Scenario B fits well with just 27% of your nett income going towards your mortgage and an additional 16% of funds being available for lifestyle and savings going forward.

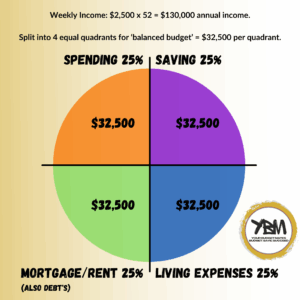

See diagram above:

In an ideal world where your budget is balanced you will be able to allocate:

- 25% to your spending.

- 25% to your savings/future wealth creation.

- 25% to your mortgage/rent/debts (ideally clear all debts).

- 25% to your living expenses (long-term bills).

To free up additional cashflow in your household budget, consider paying off your personal loans and debts prior to becoming a home owner and seek to reduce utility costs (insurances, mobile phones, and subscriptions etc). If your spending is above and beyond the targets listed above do the same (meal plan, prepare for date nights, include fun but pull back if overspending). Always seek ways to reduce the expenditure of your outgoing income as possible – but never at the detriment of your lifestyle (so long as your lifestyle is exorbitant – and if it is, consider if now really is the time for home ownership).

Purchasing your home in today’s market is easy when you know your numbers and do the work to lead yourself forward. Sure, you may need to make some strategic changes in your lifestyle and purchasing decisions, or reconsider the area you most desire for ‘down the track’ once you have built equity in your new home, but the key is that yes you can become a home owner in the current market, but only if you are savvy and prepared on all fronts.

Crunch your numbers, do your homework and if you get stuck and need professional support please reach out.

Source – https://mozo.com.au/home-loans/articles/what-is-the-average-mortgage-in-australia

Source – https://mozo.com.au/home-loans/articles/what-is-the-average-rent-in-australia