Early July 2019, we started working with a client who was completely embarrassed about their situation. They had unsecured debt of nearly $40,000 plus a car loan, plus a mortgage, all whilst being a single parent with 2 children. They were stressed to the max with late fees on their credit cards, and worked in a job where income was inconsistent. Some weeks their pay was high, other weeks their pay was low. It was the low weeks that really effected our clients ability to stay on top of their finances. Additionally, their credit score was shot to pieces, meaning a simple refinance of unsecured debt into the home mortgage was completely out of the question.

From the initial appointment through the following months we worked on a plan that allowed our client to have the same amount of money each week for the essentials they required – groceries, petrol, medications and even a weekly spending allowance to spend on whatever they felt like during that week. This meant that our client had consistency. Once the money was spent, our client knew that it would be there again the following week. It meant that our client could stop relying on credit (and increasing their unsecured debt), and they could start living their life!

Once we had implemented a simple weekly cashflow, we then took a hard look at the unsecured debts, the mortgage and car loan and developed another plan around the high and low pay cycles that made sense, was simple, easy to implement, but most of all – delivered real results and got creditors off our clients back. Our initial client meeting showed that their current unsecured debt was costing them $550 per week and over $2,300 per month, so you can understand how frustrated and under pressure our client felt. The debt has been crippling their household.

Since working with us, our client has paid down approximately $750 per month extra to their unsecured debt so far – consistently! Over the quarter this means they have paid an extra $2,250, in 6 months $4,500, in 12 months a whopping $9,000 of unsecured debt paid, all whilst being a single parent on a modest income! Our client is on-track to exceed this target by snowballing their debt. Essentially, the more we pay off, the more we can snowball, and its all part of the simple, easy to follow plan provided by Adelaide Budgeting.

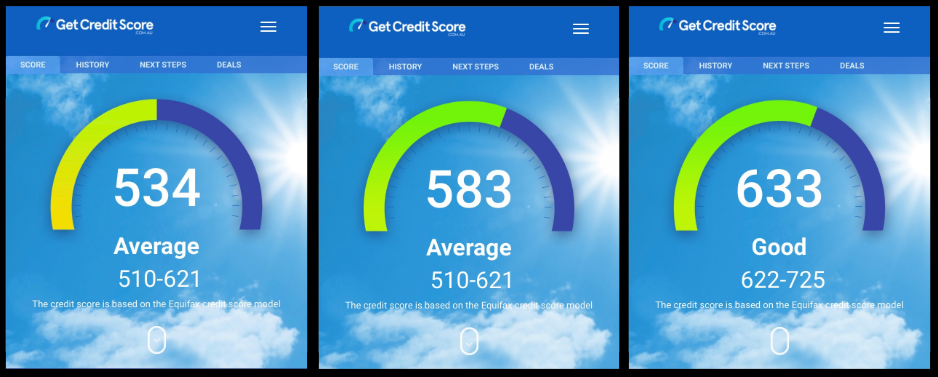

What we didn’t know about our client was that prior to signing up with us, they had been tracking their credit score each month via an app on their phone. The results…? That’s nearly a 100 point improvement in as little as 3 months! That is AMAZING and the result of a dedicated client; willing to put in the effort; willing to stick to the program; to achieve REAL RESULTS in their life!

Score 534, 2nd of June 2019 – a month prior to working with Adelaide Budgeting.

Score 583, 15th of August 2019 – a month after working with Adelaide Budgeting.

Score 633, 5th of September 2019 – 3rd month after working with Adelaide Budgeting.

We are only 3 months in, on a 12 month plan for our client and we cannot wait to see what the next 9 months have in store!!

We love creating amazing cashflow strategies for our clients; no matter how challenging they may be! If you want to find out who we are; why we are different; and what we can do for you then please give us a call today 0420 846 454. You will soon realise that there is nobody in the market today quite like Adelaide Budgeting that are delivering real results where it counts with so much simplicity!

We love working with clients who have the desire, the will, and the want for amazing positive change in their lives. If you are struggling to get ahead financially or know somebody that is, please pass this information onto them so we can connect and help them.